An income statement is a financial statement that reports the revenues and expenses of a company over a specific accounting period.

It shows whether a company has made a profit or loss during that period.

It is also known as the profit and loss (P&L) statement, where profit or loss is determined by subtracting all expenses from the revenues of a company.

An income statement shows how effective the strategies set by the management at the beginning of an accounting period are.

It also helps business owners determine whether they can generate high profit by increasing prices, decreasing costs, or both.

Businesses have two reporting options when preparing an income statement.

They can create a multi-step income statement or a single-step income statement.

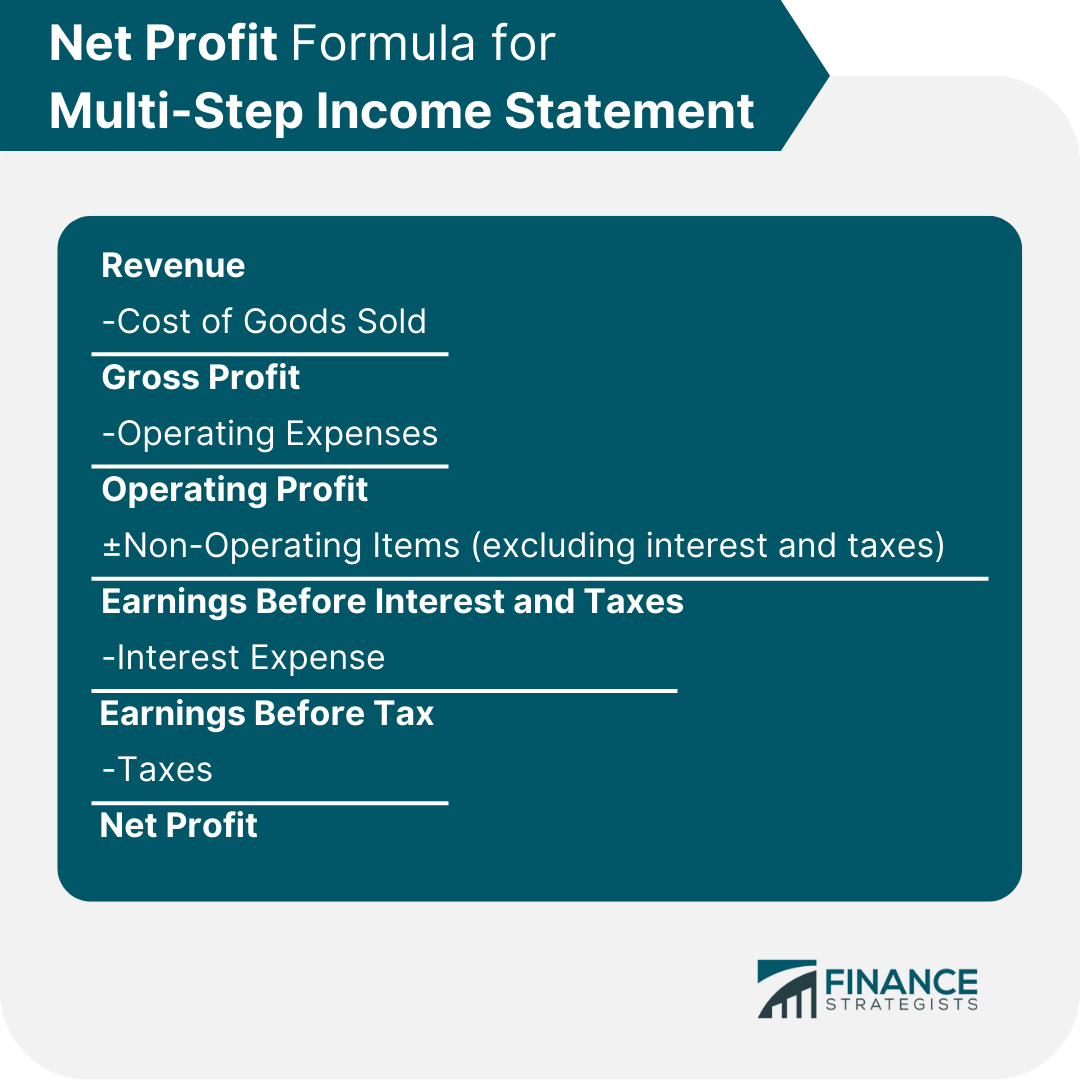

The multi-step income statement provides an in-depth analysis of the financial performance of a business in a specific reporting period by using these profitability metrics.

This makes it easier for users of the income statement to better comprehend the operations of the business.

Revenue is the income generated from normal business operations. It is displayed at the top line of an income statement.

Depending on the company, revenue can also be called “sales revenue” or “sales.”

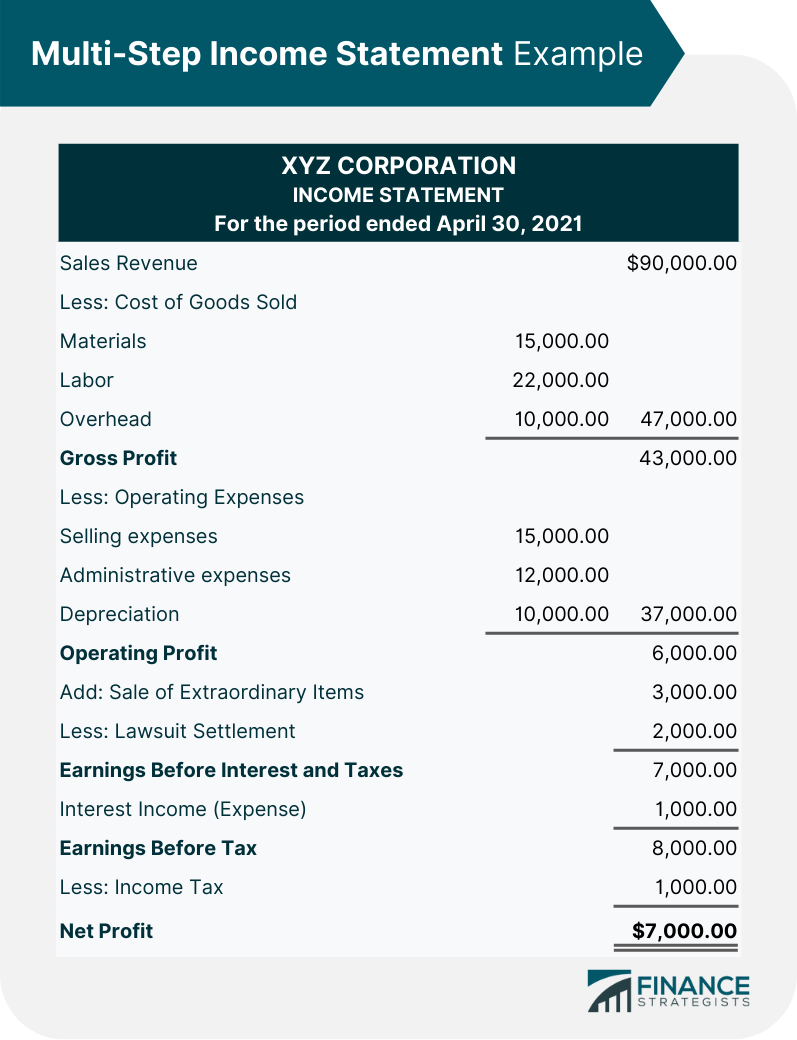

The illustration above comprehensively shows the different levels of profitability of XYZ Corporation.

It starts with the top-line item which is the sales revenue amounting to $90,000.

From this amount, the cost of goods sold amounting to $47,000 is deducted in order to arrive at the first level of profitability which is the gross profit.

Operating expenses totaling $37,000 were then deducted from the gross profit to arrive at the second level of profitability - operating profit which amounted to $6,000.

After taking into account all non-operating items, the bottom line of the company showed $7,000 as net profit.

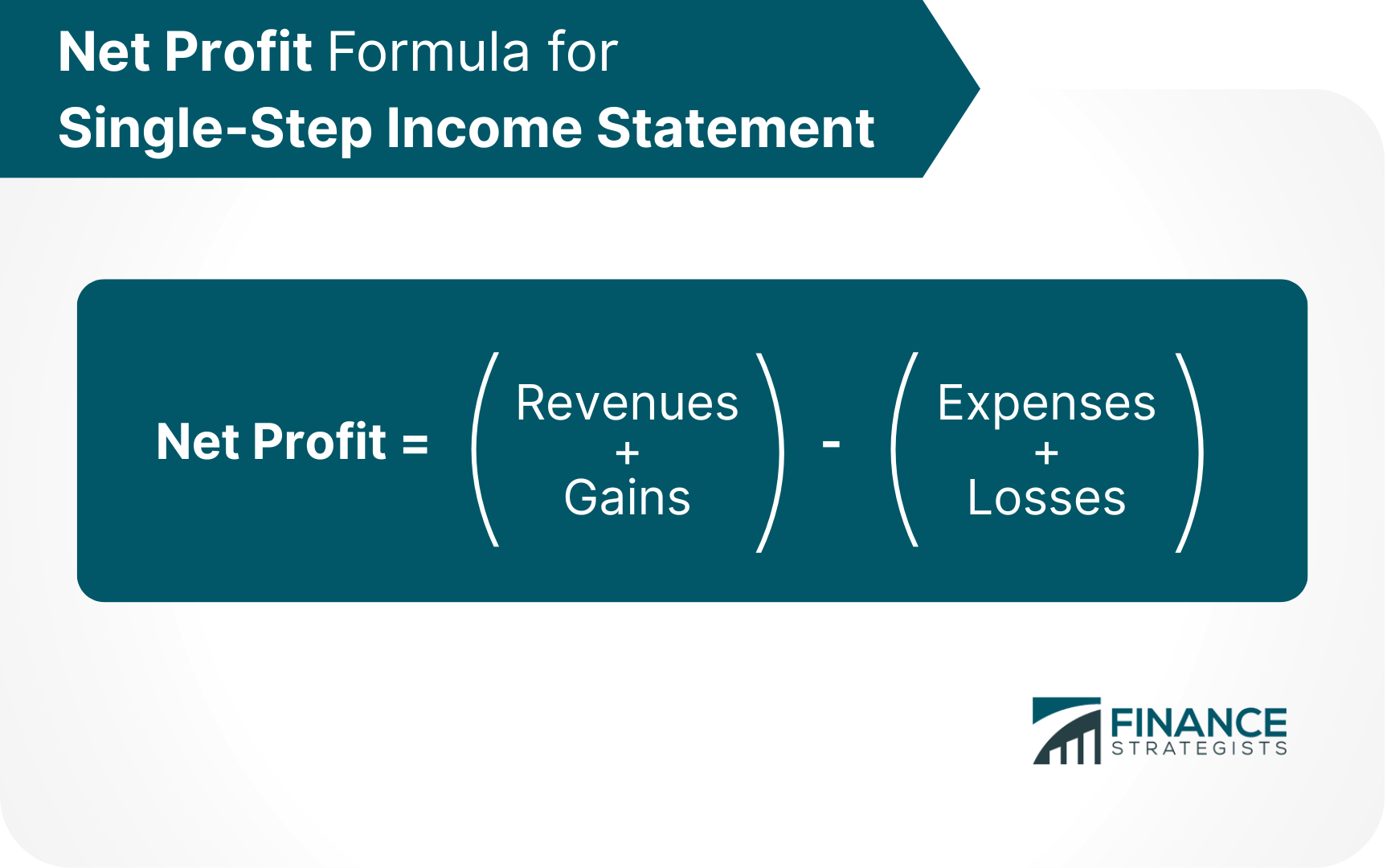

A single-step income statement displays the revenue, expenses, and gains or losses generated by a company.

It reports these figures by using just one equation to calculate profits.

The equation used in a single-step income statement is:

A single-step income statement is useful when your business does not have complex operations or only needs a simple statement that could report the net income of a business.

It is also practical to use this format when you do not need to separate operating expenses from the cost of sales.

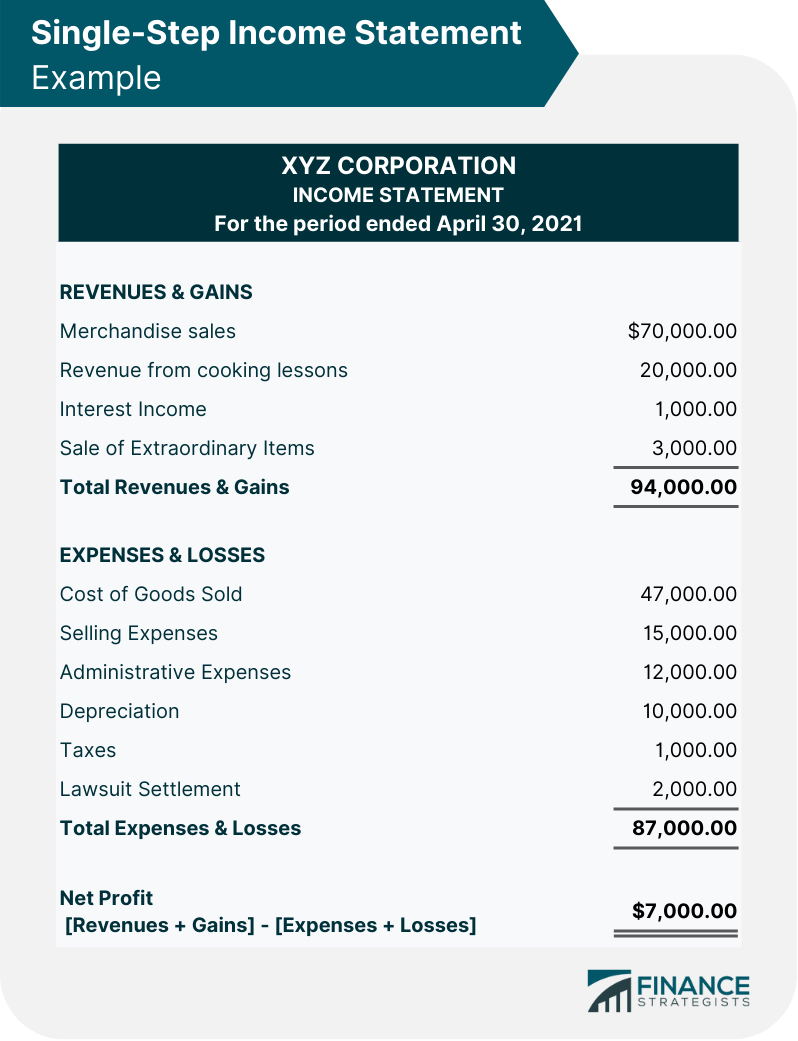

Revenues are the result of the company’s primary business activities.

Gains represent all other sources of income apart from the company’s main business activities.

Examples of gains are proceeds from the disposal of assets, and interest income.

Expenses are how much it costs for a business to keep running and make money.

Losses can be the result of one-time or any other extraordinary expenses, or lawsuit expenses.

The single-step income statement lumps together all of XYZ Corporation’s revenues and gains and these amounted to $94,000.

Its expenses and losses are also lumped together totaling $87,000.

Using the net profit formula we had above, we find that:

Net Profit = (Revenues + Gains) – (Expenses + Losses)

Income statements are generally used to serve as a reporting metric for various stakeholders.

It provides them with a summary of the performance of the company during a specific period.

The income statement benefits various stakeholders in several ways.

With the income statement detailing the categories of revenues and expenses of a company, management is able to see how each department of a company is performing.

It helps managers and business owners point out which company expenses are growing at an unexpected rate and which of these expenses need to be cut down in the future.

Directors and executives are also provided a clear picture of the performance of the company as a whole during a specific accounting period.

Income statements serve as an indicator of how successful the implemented strategies are and whether there are areas that need improvement.

Income statements also provide a good source of analysis for investors that are willing to invest in the business.

Typically, investors prefer looking at a company’s operating profit figure rather than a company’s bottom line as it gives them a better idea of how much money the company is making from its core operations.

Financial institutions or lenders demand the income statement of a company before they release any loan or credit to the business.

This is because lenders want to know the ability of the company to generate revenue and profit, as well as its capacity to repay the loan.

The income statement is also vital for ratio analysis, equity research, and valuation of the company.

It helps analysts and research houses analyze, forecast, and perform corporate valuation in order to create future economic decisions in the company.

An income statement is one of the most important financial statements for a company.

It provides insights into a company's overall profitability and helps investors evaluate a company's financial performance.

Income statements can be complex, but understanding the different components is crucial to interpretation.

Income statements provide a summary of the performance of a company during a specific accounting period and are useful for various stakeholders like management, investors, lenders, and creditors.

It can also be used to make decisions about inorganic or organic growth, company strategies, and analyst consensus.

Income statements are an essential part of a company's financial reporting.

While an Income statement is vital for the business, it should be noted that an Income statement is just one of the three financial statements.

The other two important financial statements are the balance sheet and cash flow statement.

All three documents must be reviewed together to get a clear picture of the financial health of the business.

An income statement should be used in conjunction with the other two financial statements.

An Income Statement is a financial statement that shows the revenues and expenses of a company over a specific accounting period. It tells whether a company has made a profit or loss during that period.

Income statement evaluates the profit or loss of a business over a period of time, whereas balance sheets show the financial position of a business at a specific point in time.

Income statements are important because they show the overall profitability of a company and help investors evaluate a company's financial performance. Income statements can also be used to make decisions about inorganic or organic growth, company strategies, and analyst consensus.

EBITDA is not normally included in the income statement of a company because it is not a metric accepted by Generally Accepted Accounting Principles (GAAP) as a measure of financial performance. However, EBITDA can be calculated using the information from the income statement.

Revenue, cost of goods sold, gross profit, selling, general and administrative expenses, depreciation and amortization expense, operating profit, interest expense, other expenses, earnings before taxes, and income taxes are the common items included in an income statement.

About the Author

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.

WHY WE RECOMMEND:

Fee-only financial advisors are paid a set fee for their services. They do not receive any type of commission from the sale of products they are advising on.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

WHY WE RECOMMEND:

Fee-only financial advisors are paid a set fee for their services. They do not receive any type of commission from the sale of products they are advising on.

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

Content sponsored by 11 Financial LLC. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. A copy of 11 Financial’s current written disclosure statement discussing 11 Financial’s business operations, services, and fees is available at the SEC’s investment adviser public information website – www.adviserinfo.sec.gov or from 11 Financial upon written request.

11 Financial does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to 11 Financial’s website or incorporated herein, and takes no responsibility therefor. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

© 2024 Finance Strategists. All rights reserved.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.